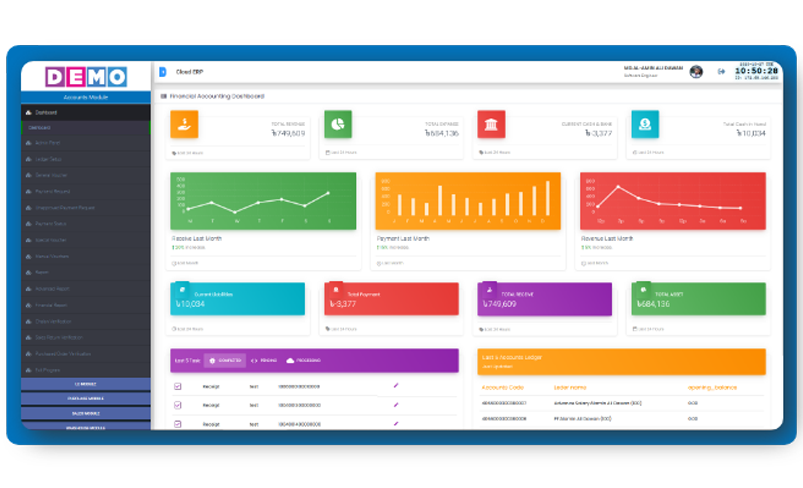

A cloud-based ERP Loan Management Solution provides businesses with a comprehensive platform to manage loan processes efficiently. Hosted on remote servers, this software offers scalability, accessibility, and security, allowing businesses to streamline loan origination, servicing, and collection processes from any location with internet connectivity. The Loan Management Solution automates tasks such as loan application processing, credit evaluation, disbursement, and repayment tracking, ensuring compliance with regulatory requirements and improving operational efficiency. By centralizing loan data and providing real-time insights, this software enables businesses to make informed decisions, mitigate risks, and optimize loan portfolio performance for sustainable growth.

The Loan Module automates the loan application process, allowing businesses to collect applicant information, perform credit checks, and evaluate eligibility criteria efficiently.

Credit evaluation and risk assessment consider factors such as credit history, income stability, debt-to-income ratio, and collateral value to determine the borrower's creditworthiness and assess the risk of default.

The ERP software facilitates loan disbursements by automating fund transfers, generating disbursement schedules, and tracking disbursement status to ensure timely and accurate fund allocation.

es, the ERP software provides real-time tracking of loan repayments, delinquencies, and collections, enabling businesses to monitor borrower activity and take proactive measures to mitigate risks.

The Loan Module offers reporting and analytics tools that provide insights into loan portfolio performance, profitability, and risk exposure, enabling businesses to optimize lending strategies and drive business growth.